Children & Youth

Every child deserves to grow up happy and healthy with access to proper education and healthcare. Whether you’re looking to support a children’s charity or your local youth club – we’ll help you make it happen on JustGiving.

Start fundraising now for a charity changing children’s lives. Take part in an event or do your own thing.

- Create your page in minutes

- Donations go directly to your chosen charity

- Get Gift Aid on your donations

Raise money to support your local youth club or provide food parcels for children and families in need.

- Create your page in minutes

- Donations go directly to your bank account

- 6-10 working days

Fundraisers we love!

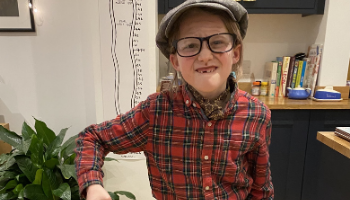

Dress-up fun

From Freddie Mercury to Gretta Thunberg, Pearl dressed up every day until she went back to school to raise money for children less fortunate than her.

Just Jump Project

By taking jump ropes into schools, youth clubs and after school clubs, children can develop so many important life skills.

#EndChildFoodPoverty

Bromley Brighter Beginnings provided the children they support, who receive free school meals, with a supermarket voucher of £15 each to get them through the half-term.

Charities you can support

Great cause, great people, doing great things.

- Eva

The easiest place to raise money for a good cause with all the fuss taken out of it.

- George